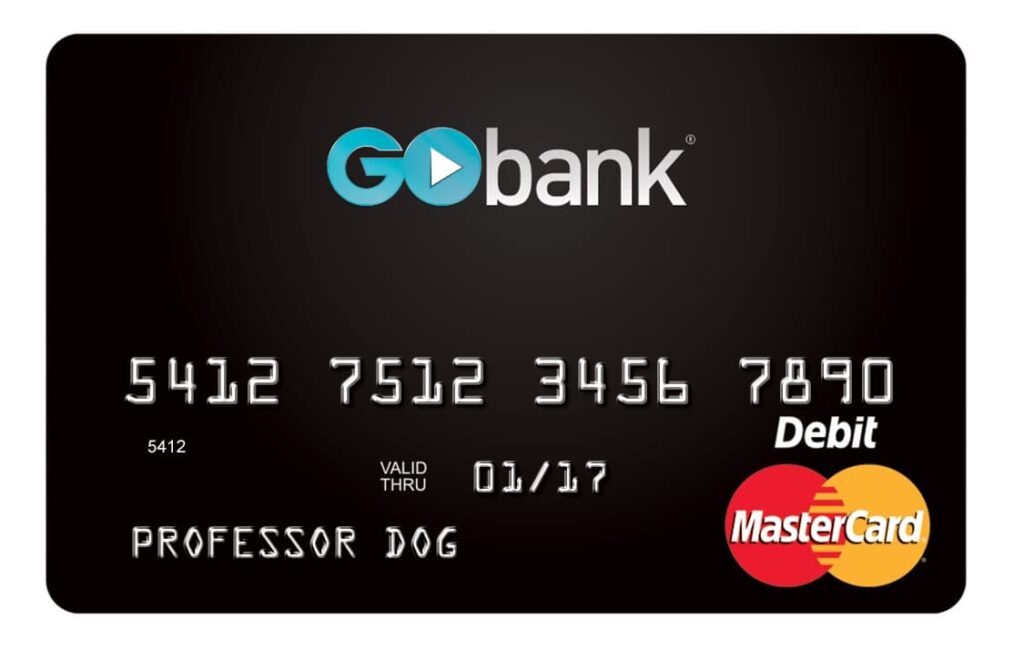

If you suddenly receive a Gobank card in the mail, it makes sense that you may be a little suspicious, so what does it mean?

Why did you receive a Gobank card in the mail? The most common reason why you’ve received an unsolicited Gobank card in the mail is because one of their partners opted you into their marketing programs. You may also receive one if you were a prior Gobank customer. However, there are other reasons like potential fraud.

We’re going to take a closer look at some of the reasons why you’ve received a Gobank card in the mail and what you should do if you don’t want to become a customer.

We understand that it’s rather worrying to receive something unsolicited in the finance industry, but the wide range of possibilities makes it hard to condense everything into a simple answer.

Why Did I Receive a Gobank Card in the Mail?

The most common reason why you received a Gobank card in the mail is not because of fraud or anything nefarious, though that’s still a possibility.

However, Gobank has a program in which they send out debit cards to potential customers based on info that they have from others or from prior contact with you.

For example, if you opted into marketing from one of Gobank’s partners, it’s possible that they shared info about you with Gobank that convinced them to send you the card.

However, this isn’t the only way that Gobank can potentially decide to send out a card to you. This is also possible if you were previously one of the bank’s customers.

Keep in mind that receiving one of these cards doesn’t necessarily mean that something has been done on your behalf.

The card that is sent out to these customers should have an inactive account and should not have any value unless it’s been activated by the person who received it.

This also means that a credit check wasn’t performed without your consent, as that would be against financial regulations.

If you don’t want to become a Gobank customer, then you have to do nothing more than avoid activating it and then destroy the card, though it may be a good idea to see if the bank card is active before doing so in case of potential fraud.

Avoid Future Gobank Offers

If you don’t want to receive any future offers from Gobank, you can also opt out of the program online.

If you’d rather send it in writing, you can send it to Gobank’s Pasadena PO box.

Be sure to include your name and address and make it clear that you would like to opt out of their program.

Gobank Card Fraud

The issue with Gobank sending out cards to everyone is that it makes them an obvious target for people perpetrating financial schemes and fraud unlike some of their competitors like Cash App or Bank of America.

If you notice that the bank is sending you texts or has mentioned that your account is activated, there’s a good chance that someone opened up an account in your name.

This is a common practice amongst those who perpetrate unemployment fraud schemes, in which they take out unemployment in your name and then have the money sent to the Gobank account.

They then typically find a way to access the money, and if you don’t fix the situation, you may be on the hook for it.

Thankfully, there are usually some pretty clear traces that someone stole your identity and opened up a Gobank account in your name, so you don’t have a lot to worry about.

However, it is still a good idea to get the situation sorted out as soon as possible to minimize the chances of something coming of it.

Notifying Gobank of Identity Theft

Since Gobank is an FDIC bank, you can get in touch with them if you feel like your identity has been stolen and an account has been opened in your name.

The issue is that it’s rather challenging to get in touch with a person and not a bot.

When you’re dealing with identity theft, the last thing that you want to do is provide someone else with your information, but that’s exactly what the Gobank helpline requires.

You will likely have to enter your social security number as well as your phone number if you want to get in touch with a person.

Some customers have even resorted to using fake SSNs and phone numbers to get through the phone line.

Keep in mind that we don’t condone this action but this shows you the lengths that people have had to go to so that they could get in touch with Gobank.

What to Do if Your Identity Has Been Stolen

If your identity is being used for fraud, it’s a good idea to take precautions like getting in touch with Gobank through any possible channels and freezing your credit.

Some scammers may end up overdrawing your accounts and leaving you on the hook for whatever money was taken out.

Other customers reported having better luck getting in touch with the Green Dot Corporate Resolutions Center.

Some mentioned that they had to provide the last four digits of their SSN while others declined to provide it and were still able to sort out the issue without any trouble.

After fixing the issue through Green Dot, customers were informed that their information could not be used to open up any further accounts.

This seems like one of the more straightforward ways to deal with any issues that may arise when it comes to Gobank and identity theft schemes.

Others mentioned that it’s a good idea to get in touch with their local unemployment or disability offices and inform them that someone has been trying to make false claims.

All of this will ensure that you’re as well-covered as you can be when it comes to dealing with identity theft.